Key Takeaways:

- Pet proprietors can select in accident-only, accident-and-illness, and wellness plans to offer assistance cover strong veterinary bills all through their pet’s life. It covers diagnostics, surgery, hospitalization, and medicine medication if your pet gets to be sick or injured.

- Coverage can change over suppliers. Most will cover common wounds and sicknesses, like cancer, diabetes, and broken bones; in any case, scope for certain medicines and administrations, like microchipping, behavior treatment, and dental care, can change.

- Pet protections works in an unexpected way from human wellbeing protections. Ordinarily, pet proprietors pay their vet charge forthright, and after submitting a claim, their pet protections supplier repays them.

What is Secured by Pet Insurance?

Pet protections ordinarily cover unforeseen wellbeing issues that can emerge with your pet, such as mishaps, ailments, and conditions. A few arrangements can moreover cover progressing concerns like unremitting and genetic conditions. Depending on your approach, the taking after wellbeing conditions and medications are frequently covered.

Illnesses and Injuries

- Accidental wounds (broken bones, gashes, harmful ingestion)

- Severe ailments (cancer, heart infection, epilepsy)

- Common sicknesses (loose bowels, spewing, infections)

- Hereditary and innate conditions (hip dysplasia, cherry eye, kidney malady)

- Chronic conditions (diabetes, respiratory issues, allergies)

- Behavior issues (division uneasiness, hostility, dangerous behaviors)

Procedures and Treatments

- Diagnostics and imaging (ultrasounds, MRIs, X-rays)

- Emergency care

- Medical procedures

- Surgery and hospitalization

- Prescription medications

- Cancer medications (chemotherapy, radiation, rehabilitation)

- Alternative treatments (needle therapy, chiropractic care, hydrotherapy)

However, keep in mind that your correct scope will depend on your approach. For case, a few pet guarantees cover behavioral issues as portion of their standard scope, whereas others offer them as an add-on or discretionary wellness plan.

Types of Pet Protections Plans

There are three primary sorts of pet protections scope – accident-and-illness, accident-only, and wellness plans. The sort of arrange you select will influence what your pet protections covers.

Accident-and-illness

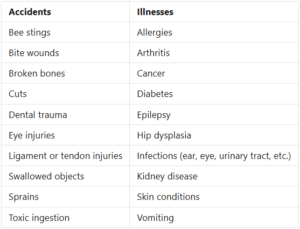

Accident-and-illness arrangements is the most comprehensive scope for your pet, covering a extend of veterinary issues, counting wounds, extreme sicknesses, and persistent conditions. Whereas correct scope can shift over pet protections suppliers, the taking after mishaps and ailments are commonly secured beneath this sort of plan.

Note that an accident-and-illness arrange will not cover preexisting conditions. In any case, a few guarantees will consider certain preexisting conditions “cured” and qualified for scope if there are no repeating side effects and no treatment has been given for a set period (as a rule 12–18 months).

Accident-only

Accident-only arrangements cover the fetched of diagnosing and treating your pet after a startling damage once your deductible is met. As the title suggests, an ordinary accident-only pet protections arrange covers the care and treatment for coincidental wounds, such as gashes, broken bones, creature chomps, and outside protest ingestions.

Treatment of sudden or persistent ailments, preventative care, and customary check-ups are not secured by an accident-only plan.

Wellness or preventative care plan

Wellness plans are common add-ons to supplement standard scope, in spite of the fact that a modest bunch of suppliers may offer them as stand-alone plans. These plans offer assistance pay for schedule pet care, empowering pet proprietors to remain on best of regular preventive care for their textured friends.

Some pet protections wellness and preventative care plans have a yearly advantage restrain, whereas others have a set dollar sum per secured cost. Like the standard protections plans, scope shifts by insurer.

A commonplace wellness approach covers:

- Blood, fecal, and pee tests

- Dental cleaning

- Deworming

- Exam fees

- Flea, tick, and heartworm medication

- Microchipping

- Spay/neuter surgery

- Vaccination

- Wellness visits

What Isn’t Secured by Pet Insurance?

All pet protections approach come with confinements and prohibitions that you ought to get it sometime recently enlisting in coverage.

Pre-existing conditions

Pet protections doesn’t cover preexisting conditions. Safeguards characterize a preexisting condition as any harm or sickness your pet creates some time recently scope goes into impact or amid a holding up period. To maintain a strategic distance from being denied scope for preexisting conditions, enlist your pet promptly upon appropriation and keep records of all therapeutic exams.

Some guarantees will consider a pre-existing condition settled if the pet hasn’t required treatment or medicine nourishment for the issue for at slightest one year.

Waiting periods

Most guarantees force a holding up period, or a set period after the arrangement has been obtained some time recently scope authoritatively starts. Depending on the company, holding up periods can run from 48 hours to a couple of weeks – longer for orthopedic or cruciate tendon issues. Any sicknesses or conditions that emerge amid the holding up period are considered pre-existing and will not be covered.

Some arrangements have isolated holding up periods for certain sicknesses, so it’s critical to peruse your approach terms carefully.

Wellness expenses

Unless you buy a wellness arrange, pet protections will not cover exam expenses, immunizations, schedule bloodwork, microchipping, spay/neuter surgery, and other preventative care for your pet.

Breeding or pregnancy

Many pet protections plans won’t cover the costs related with breeding or whelping creatures, counting, but not restricted to, complications coming about from creature pregnancy. In any case, this sort of scope may be accessible with a few safeguards, like Trupanion, as add-on coverage.

Other exclusions

Pet protections as a rule doesn’t cover the fetched of diagnosing or treating preventable ailments, two-sided conditions (or those that influence both sides of the body), elective strategies, restorative strategies, or behavioral problems.

How Much Does Pet Protections Cost?

The taken a toll of pet protections depends on a few variables, counting your pet’s species, age, breed, where you live, and the sort of approach you select. In common, it costs more to purchase pet protections for a pooch than it does for a cat, in spite of the fact that month to month premiums can change broadly from back up plans to insurer.

Based on our investigation, the proprietor of a 1-year-old mixed-breed female pooch can anticipate to pay anyplace from approximately $27 to $277 per month for a arrangement with a $500 deductible, a 90% repayment rate, and a $5,000 scope constrain. The same arrangement for a male household medium hair cat beneath 1 year ancient can extend from around $12 to $90 per month.

Monthly costs are for a 1-year-old female Mixed-breed pooch and an under-1-yo male residential medium hair cat, individually, in fabulous wellbeing dwelling in Texas, for a $500 yearly deductible, $5000 yearly advantage restrain, and 90% repayment rate. * Trupanion has zero deductibles and boundless payouts with no yearly, lifetime, or per occurrence scope caps. Test costs are exclusively based on a 90% repayment level. Scope has as of late expanded in Arizona, Florida, Maine, and Texas. ** ASPCA Pet Wellbeing Protections: Test month to month costs are based on a $4,000 yearly advantage restrain, a $500 yearly deductible, and a 90% repayment level. *** Across the nation: Test month to month costs are based on a settled $10,000 yearly advantage restrain, a settled $250 yearly deductible, and a 70% repayment level.

Coverage Limits and Deductibles

Most pet protections suppliers permit you to select the scope constrain, deductible, and repayment rate for your pet’s arrangement. The choices you make when customizing these components can have an effect on your premiums.

For occurrence, a arrange with a higher deductible or lower repayment rate and yearly restrain may take a toll less in premiums. But you may have more out-of-pocket costs if your pet is harmed or sick. It’s critical to customize a arrange that fits your budget whereas giving satisfactory scope for your pet.

Coverage limits

Your policy’s yearly scope constrain is the most extreme sum the protections company will repay you for your pet’s therapeutic care in a year. With most safeguards, you’ll be able to select from numerous choices. Among suppliers included in our Best Pet Protections Companies rating, we found yearly scope limits extending from $2,500 to $100,000, with a few guarantees too advertising boundless plans.

Keep in intellect that you’ll be capable for the fetched of care that surpasses your policy’s limit.

Deductibles

A pet protections deductible is the sum you must pay in vet costs some time recently your supplier starts repaying you. By and large, the higher the plan’s deductible, the less you’ll pay in month to month premiums – but the more you’ll pay out of stash some time recently scope kicks in.

Among suppliers in our national rating of the best pet guarantees, deductibles as moo as $50 and as tall as $1,000 are accessible. Distinctive companies may have diverse choices to select from.

Reimbursement amount

Most pet protections companies repay you for a rate of your pet’s restorative costs after your deductible is met. Numerous permit you to select your repayment rate – for occasion, 70%, 80%, or 90%. A few guarantees indeed offer a 100% repayment choice, in spite of the fact that you’ll likely pay a bit more for such a policy.

How To Get Pet Insurance

Purchasing a pet protections arrangement can be a generally fast and simple involvement, as it can frequently be completed online. But some time recently you get to that organize, it would be shrewd to do small research.

Most pet safeguards offer two fundamental plans – accident-and-illness or mischance as it were. You’ll need to learn almost what’s secured and make beyond any doubt that it adjusts with your expectations.

Rates and customization choices will change over pet protections suppliers. Our report on the Best Cheap Pet Protections Companies talks about estimating and arrangement highlights for a few companies in our rating of the best pet insurers.

Companies moreover offer shifting discretionary inclusions, alluded to as add-ons, that can cover things you might not have considered. Common add-ons can incorporate exam or boarding expenses, wellness plans, and elective therapies.

After choosing on the inclusions that matter most to you, compare cites from distinctive companies to offer assistance make beyond any doubt you’re getting a competitive rate. You’ll require to reply a few fundamental questions, such as:

- The sort of pet you have (most guarantees in our rating as it were cover mutts and cats)

- Your pet’s age and breed

- Where you and your pet live

- Information approximately your pet’s wellbeing history

Requirements related to pet therapeutic records shift by back up plans. Not all companies require records at enrollment, but at a few point the back up plans will ask documentation related to your pet’s wellbeing history. This may happen when you record a claim.

It’s critical to see over approach reports carefully. Keep in intellect that preexisting conditions will by and large not be secured.